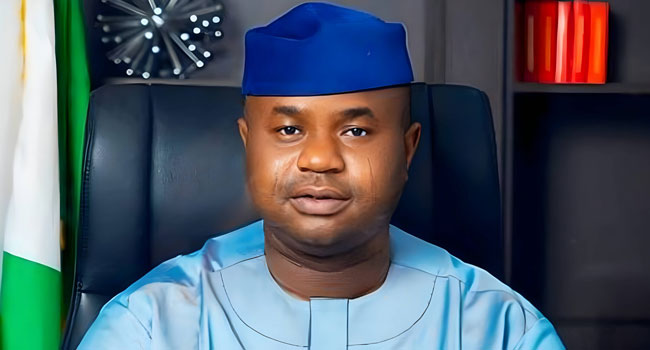

When considering how to drive economic growth in Nigeria, Zacch Adedeji, the Executive Chairman of the Federal Inland Revenue Service (FIRS), is making significant strides with his approach to revenue generation and infrastructure development. His message is clear: unlocking Nigeria’s economic potential requires a combination of transparency, efficiency, inclusivity, and a renewed focus on public-private partnerships.

Adedeji has consistently emphasized that to overcome Nigeria’s current economic challenges, the government must improve tax administration while fostering innovation across various sectors. By streamlining tax processes, simplifying them, and focusing on fair and transparent systems, he believes that Nigeria can increase compliance, reduce corruption, and dramatically enhance revenue collection. This, in turn, could lead to greater investments and provide the government with the resources needed to address critical infrastructure gaps.

Importantly, Adedeji is advocating for a fundamental shift in how Nigeria generates revenue. For him, the focus should not solely be on adjusting existing tax rates; it is essential to diversify Nigeria’s income streams. He highlights the potential of underutilized sectors such as tourism, agriculture, and technology, which could drive significant economic growth. Incorporating these sectors could reduce Nigeria’s dependence on oil revenues and pave the way for higher exports and more sustainable income sources.

One of the key strategies Adedeji champions is the use of public-private partnerships (PPPs). He points to the Road Infrastructure Tax Credit Scheme, a successful initiative launched in 2019, as a model for collaboration between the public and private sectors to address the country’s infrastructure challenges.

This scheme allows private companies to invest in vital road projects in exchange for tax credits, thereby encouraging private sector participation in national development. Adedeji argues that such innovations can help Nigeria overcome funding constraints and deliver critical infrastructure that supports economic progress.

Additionally, Adedeji calls for smarter management of public assets. With numerous government-owned properties underused or under-leveraged, he suggests that better utilization of these assets—whether through leasing or sales—could significantly boost national revenue. By turning idle resources into cash-generating assets, Nigeria could reduce its fiscal deficit and further support infrastructure development.

Digital technology also plays a crucial role in Adedeji’s approach. He sees it as an essential tool to enhance transparency and efficiency in revenue collection. According to him, technology can streamline operations, reduce corruption, and create a more robust fiscal environment. It’s not just about making tax collection easier; it’s about making it smarter and more transparent.

Regarding Value Added Tax (VAT), Adedeji proposes expanding the tax base instead of increasing rates. By broadening the range of goods and services subject to VAT, the government could increase tax revenue without burdening the average consumer. This approach can help minimize tax evasion and ensure that the system remains fair.

Ultimately, Zacch Adedeji’s ideas aim to create a dynamic, transparent, and growth-oriented tax system capable of fueling Nigeria’s economic rise. His belief in public-private partnerships, technological innovation, and smarter asset management could provide a blueprint for long-term economic stability and growth.